CBRE: How the Worlds Largest Real Estate Services Firm is Leveraging Technology to Better Serve their Clients.

When it comes to Real Estate Services and Investment firms, CBRE is the largest player in the world. CBRE has been known for their brokerage, facilities management, investment sales, and other related services, but over the past few years they have expanded aggressively into other segments of the industry. In 2018 they entered into flexible real estate by launching their in-house brand Hana. Then, in February of this year, they doubled down on flex with a $200M investment in Industrious (CBRE merged their Hana brand with Industrious in conjunction with this investment).

CBRE’s growth strategy not only includes new services. They are also embracing technology in a big way. CBRE is leaning into PropTech to arm their brokers, landlord partners, and occupiers with data to make more informed decisions. They are also leveraging solutions to improve tenant and employee experience, increase NOI, and measure important metrics like occupancy. Along with deploying 3rd party technology throughout their portfolio, they have also been investing into their own homegrown solutions. As an example, CBRE was the first major brokerage to launch their own Tenant & Employee Experience App: CBRE Host.

I first learned about Host when we partnered with them at Kastle Systems to provide mobile access control functionality. Access control is a vital element of Tenant Experience Apps because it provides a critical utility that drives adoption. If tenants need the App to enter the building, call the elevators, and access their suite, the likelihood that they will use the App on a daily basis increases exponentially. Kastle integrated their SDK with Host, creating a powerful offering for landlords and occupiers.

I recently spent some time with CBRE Host’s Global Digital Lead, Brennan McReynolds. Brennan was extremely generous with his time, and he agreed to answer questions about Host. We covered a wide range of topics, and I found his insight to be fascinating. Below is a summary of our conversation.

What is CBRE Host?

“We have two products within the Host digital platform. One is an occupier centric offering that aligns as an enterprise digital workplace app for employee use across a global portfolio. The second is the tenant experience side which is a natural extension of how we are being tasked by our landlord clients to manage and look after activating their asset and associated experiences. We are truly in the business of elevating and optimizing experiences within the built environment. When you think about it, optimization is at the core of CBRE as a property management organization and a facilities management organization; it is about how we can deliver services on behalf of our landlord and occupier clients better and more cost efficiently than they can do on their own. That's why you've seen CBRE make the investments that we have in technologies like Host and other partners in the space.

Host is about a foundational ecosystem of partners, because every landlord and every occupier is going to have their own workplace experience stack, or tenant experience stack of technologies that will change as we move across different portfolios. Access control with Kastle is a great example. When I look at how our occupiers are using technology, it's really hard for them to come together with an overall access control strategy because they may have 20 different landlords across their different offices, or at a scale globally that could be well into the hundreds. The standardization of those digital touchpoints and experiences across a portfolio is something that will mature over time.”

Tenant Experience Apps are one of the hottest topics at the moment. Well funded startups like HqO, Rise Buildings, and Lane are gaining a lot of traction in the market. What differentiates Host from its competitors?

Anything that extends into our ability to immediately respond to and service the needs of either the tenant or the individual employee themselves is what makes us more unique and direct. Host is a natural extension of CBRE’s core business and we leverage CBRE’s deep understanding of the needs of both owner and occupier clients. We have the easiest path to providing and updating the way that experience is provided within the landlord's asset, and we understand the tenant's landscape and what attracts and retains top talent. When you get to individual features, everybody is going to say that their features are better than everyone else's. At the end of the day, we are positioned from a service-focused lens and have a deep understanding of all clients -- landlord, tenant and employee.”

As I have mentioned in prior articles, just about every landlord that I meet with has either deployed a tenant app, or are considering rolling one out. But providing tenants with a solution, and having them actually embrace it are two separate things. Do you feel confident that tenants will adopt the technology in large numbers?

“If a landlord is going to invest in a tool like this, it's important for them to look at the platform holistically - promoting the amenities they offer, driving usage to the app, and then measuring utilization and adoption of the amenities. As an example, if they just put X amount of money into their fitness center and shared amenity floor that they are going to be activating, they need to think about routing this activity through the App because it allows them to understand how the space is being utilized and whether the race to monetization is real. Conversely, they can say, ‘Well, nobody's using X, Y, or Z so it doesn’t make sense to spend more money on this, or to roll out similar amenities in other buildings in my portfolio’. And that's the power of these tools. It’s not just about elevating the experience of the asset itself, but actually measuring the utilization and interactivity of the tenants within those spaces. This allows for quick payback because landlords can see whether spending X amount of dollars per square foot more on an amenity floor will generate higher returns. It’s not just about looking at usage at the employee level, but it’s also about looking at what's happening in the tool. There is a great opportunity that the whole industry has to dig a little bit deeper into the ways that these tools are being used to make better decisions. As long as we can demonstrate value, the adoption should follow.”

I assume that your product roadmap was heavily influenced by the challenges that COVID created. How has Host evolved from pre-COVID to now?

“The biggest change has been around safety and communications. The role of technology now is to facilitate a highly communicative experience that creates confidence in the availability and role of the workplace. If I'm going to go to the office today, then how can technology prepare me to expect what's now different with how I enter the building or how I park? How do I go into the elevator lobby? How do I get into my tenancy? These are fundamental to how we think about the role that technology plays. And I think everybody's roadmaps have shifted towards a safety and communication focused organization.

Secondly, we now have to consider tenants' choices about where to work. Now that people do not have to go into the office everyday, the role of these technologies is to promote why someone should come in and the choices that they can make to interact and engage with the building. That may be based on the amentization of the building and the experiences that are being managed by the people on the ground.

It could be something as simple as it being Chick-fil-A day in the building. How can I leverage technology to find the easiest way for me to get that meal delivered to my desk? Or, perhaps it is a specific tenant experience or community engagement event like a get-together on the rooftop or a class at the gym. The challenge however is that since we moved into this home-first environment, how do we keep engagement high? How do we stay relevant? How do we choose where to work on a given day?

As an example, I have three different offices that I can go to in the Dallas area depending on what I want to accomplish and with whom. The role of how we use Host within the company is meant to help us better triangulate around where we actually work that day based on who we need to interact with or what is taking place in which office on a particular day.”

Every company is collecting more data than ever before. However, actually ingesting that data and making sense of it is still in its infancy. How do you use data to arm your team in order to make really informed decisions?

“What is important is the ability to measure intent to go into the workplace or into the office. The goal is to have the ability to begin to forecast and understand and anticipate how many people are coming into my workplace and at what time, in order to ensure safety across that entry process. The overall capacity of a building, or a floor, or even a desk within that floor is pretty fundamental. That data has a ton of value in the downstream vocations of the day-to-day services that sit in and reside within that physical workplace or building. It also has tremendous value for the long term strategy of anticipating occupancy a week, or month, or a year from now. And then how does that relate to my next lease and how much space I actually need?

We're seeing a strong interest in the measurement of space utilization through sensors. There's some foundational things that you can do with technology, like Host, that gives you a framework of who's coming into the office, how they are coming in, and at what capacity. Should a client need more data on their occupancy, we can work closely with CBRE’s occupancy management team to provide an integrated approach to both understanding who is in the office, when and how they are engaging with the office, and then deploy a great tenant experience through Host. Then there are the trends associated with this data that then help brokers make better recommendations on how much space a client needs. The day to day operations folks are using the data to say, ‘Okay, well I can shut down a floor now, because typically on Tuesdays I'm only seeing 30% capacity across five floors’. They can also begin to actually say, ‘I'm only showing reservations for four floors, because my capacity to do anything is not getting to a point where I need to have all five’.”

What are some of the most exciting technologies you've seen recently?

“I think about it in two ways: what exists today, and then what's coming. I'm very employee experience centric in my thoughts. I think about employee and tenant experience first. I like the continued pace of the sensor providers in the marketplace that are allowing us to have real time understanding of the way that space is being used and occupied so that we can make smarter decisions. I see continued improvement of not just the quality of the data and the outcomes they produce, but also the price point. We're working with one firm whose focus is on infrared sensors that are used to help clients understand directional intent, while also protecting individual privacy. By leveraging thermal signatures, you can understand from a safety standpoint whether somebody's fallen, or if they are sitting or standing without having to get into evading somebody's privacy. So understanding intent within the workplace and what people are doing, is really fundamental to how we've been thinking about adjusting the role of the workplace and the configuration of the physical environment.

In terms of future facing technology, I’m interested in anything that helps us better self organize as a team, and how to be much more deliberate or purposeful when we occupy space. When we think about Host, our mission is to elevate the employee experience by connecting them to who, how, and where (in that order) they want to work, while optimizing the delivery of that space and services. Starting with who: I'm going in because a particular colleague is in town. Next, what do we want to accomplish when we meet? Lastly, where is the best place for us to meet to be most productive and accomplish our goal? The first two answers are contributing factors to where we meet. Choices like this really didn’t exist before the pandemic normalized hybrid work strategies. Any technology that helps rightsize choices, and adds optionality in a very intuitive way, is what I'm most bullish on. There are downstream implications about the amount of space and amount of services that are provisioned as a result of those choices, and they have an effect on the way and the amount of space that companies occupy.”

Do you offer Host as a solution to tenants, or are your clients exclusively landlords?

“We have a tenant experience platform that is procured by a landlord on a building by building or portfolio basis, and then we have an employee experience platform as procured by the occupier and then distributed across their employee base on a portfolio level. It is two different products, with two different native applications, that serve two different purposes: One being for promotion of a landlord’s spaces, services, amenities, and the other being a broader more enterprise authenticated offering for occupiers to provide continuity and choice across all of their workplaces.”

The objectives of landlords and occupiers are very different from each other. Landlords are looking to lease out as much space as possible. Occupiers on the other hand, are looking to take only the space that they need. Does it create a conflict for your landlord partners if tenants are utilizing your platform to determine that they should probably downsize?

“Ultimately, the role and the purpose of the workplace-as-a-destination is to collaborate, which we believe will fundamentally shift the square foot per person back up. This will be driven by the desire to self organize. For example, a small team may take collaboration space, but then they also need a breakout room and some private call rooms. The way that we desire to come together and the way that space needs to adapt, will push that trend back upwards. So despite fewer people coming into the office on a daily basis, on days that they do come in they are going to need more space than they did a few years ago. These ratios, and the mix of ways that space is used, still needs to normalize once we all go back to capacity. We will need to wait and see what the actual downstream effect is on the amount of space that people need. I don’t believe that we will see huge trends of companies saying, ‘Oh, let’s get rid of half of our portfolio’. We have seen trends thematically with occupiers saying: ‘Let's certainly use this opportunity to optimize the way that our space is designed and how much space we need’. But I don't think we have enough concrete data yet to say what the new baseline of space will be that a company needs to take per employee.

On the landlord side, I think we'll continue to see the evolution and desire to have flexible shared landlord environments where I, as an occupier, may give back a floor, while being enrolled in or having access to more on demand or flex type spaces. These spaces would likely be managed by the landlord’s tech stack so that tenants can easily flex in and out of a different type of lease structure than what we have typically seen in the past.”

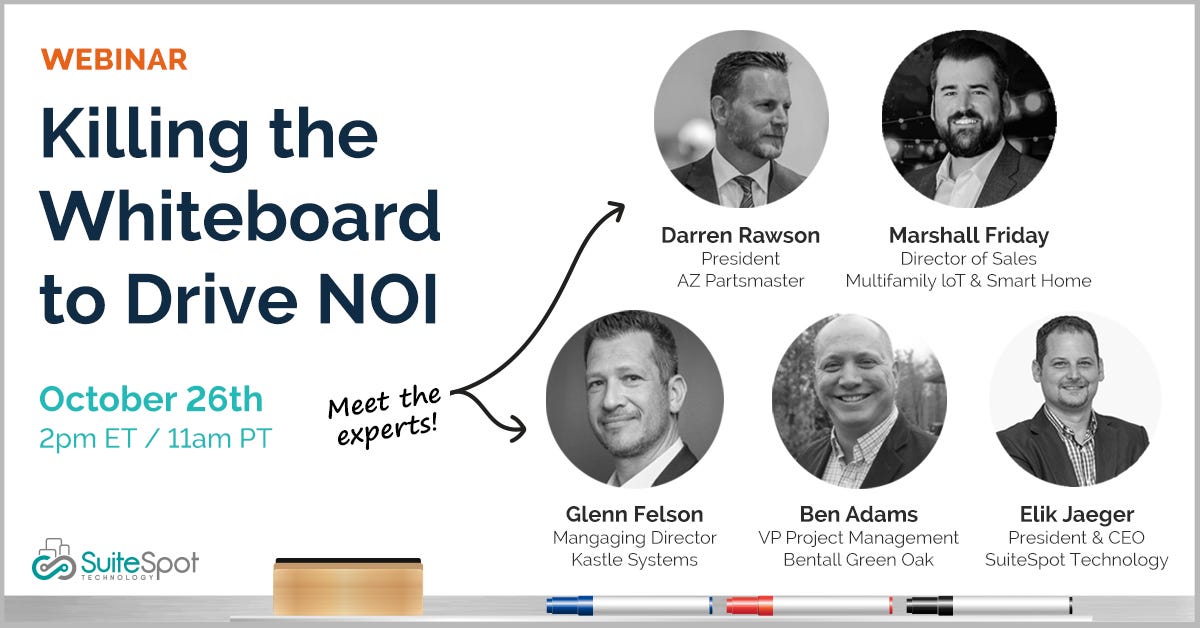

I am excited to announce that I will be moderating SuiteSpot Technologies’ webinar on using technology to improve NOI for Multifamily Real Estate Operators on October 26th at 2:00pm ET.

Please us this link to register for the virtual event. Below are some of the topics that we will be covering:

What new technologies are leading multifamily operators using?

Smart apartments (energy efficiency, access control for residents and technicians, etc.)

Smart maintenance (digital transformation of processes, automating and streamlining workflows, etc.)

Smart purchasing and inventory management

Why are they using these technologies?

Higher NOI from operational savings, faster turnaround times, and more value creation for residents

Better support and service that makes both residents and employees happier

Digitized documentation and tracking to improve visibility and compliance throughout the organization